Market Madness

Teens catch on to popular stock-trading apps.

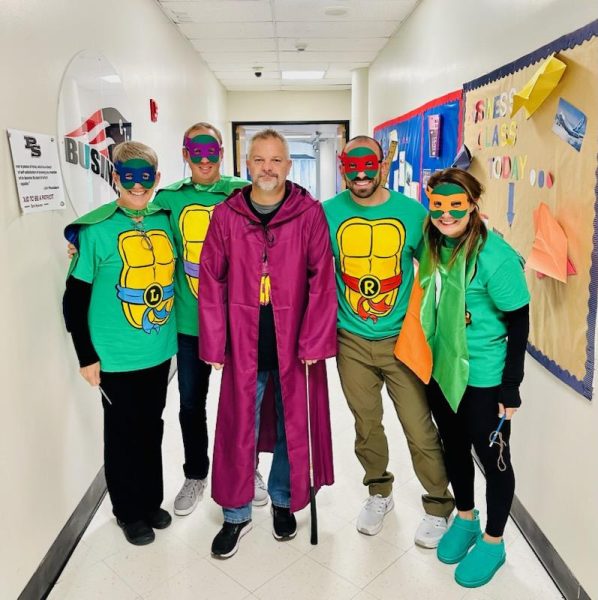

Senior Michael Chambers checks up on his Webull account during lunch.

Jan. 25-29 was a historic week on Wall Street. Teenagers, college students, and beginner investors from around the country banded together and began a takedown of hedge funds and “the Suits.”

Started by Redditors on the subreddit r/wallstreetbets/, young adults easily connected with one another to create a plan for buying and trading. Apps like Robinhood allowed these young investors to buy partial shares, giving them the ability to spend small amounts of money; and quickly. Within that week alone, hedge funds lost a substantial $14 billion on bearish bets (If you’re new to investing, the professionals on Wall Street place bets on whether companies are “bullish,” meaning they will continue to increase in price and earnings, and “bearish,” which is the opposite of bullish).

Some of the investors walk among us at Parkway South, and actively participated in the Gamestop (GME) trading frenzy. Senior Michael Chambers became immersed into the stock market before this craze, and it gave him an advantage when the GME trading began.

“I turned 18 back in May, and since that was during lockdown, I got interested and had time to explore trading a little,” Chambers said. “I began with apps like Robinhood, but after learning more and wanting to invest more, I’ve moved onto Webull and TD Ameritrade.”

Senior Anandhu Mahesh, on the other hand, has been trading for quite a lot longer.

“I’ve been paper trading since seventh grade and began real trading freshman year,” Mahesh said.

Mahesh wasn’t able to join in on Gamestop in time, but he said he made profits from AMC. AMC Theaters was the same as Gamestop, as young investors poured money in without any knowledge of the company but just continuing to push it up.

“I use Robinhood, TD Ameritrade, and sometimes Think or Swim. It just depends on what I’m researching,” Mahesh said.

Chambers, like most people, knows how important research is before investing.

“If you begin trading for the first time, make sure to do your research. I read books like ‘The Smart Investor’ and YouTubers. One of my favorite YouTubers is still the Ziptrader, and his videos continue to teach me a lot,” Chambers said.

Many beginning investors get caught up in the idea that the stock market is a get-rich-quick scheme, when in fact it takes lots of time and sometimes, even, luck. The people who make millions of dollars only do that by putting in millions of dollars.

When asked how he determines what’s right to invest in, Mahesh said, “Lots of technical analysis and recent news within the sector.”

Now that the GME explosion is primarily over, the new influx of money from young traders in the market has to go elsewhere. Bitcoin and tech companies have been two of the most popular investments for beginners, but there are always blue-chips and safe markets. Some blue-chips would be Berkshire Hathaway, S&P 500, and Dow Inc.

“I do not like or trust bitcoin specifically,” Chambers said, “but I do like the bitcoin-mining companies, like MARA or RIOT. Both do well if bitcoin does well, but also are sustainable if bitcoin fails or has consecutive bad days.”

Healthcare is a safe and specific market, especially with the pandemic, and Mahesh has capitalized on that.

“Recently, it’s been Healthcare,” Mahesh said, “For the long term: I’ve been looking into an $OCDX, an orthopedic company that, according to my charting, has lots of potential room to grow. It’s currently at $17. For the short term: Slack earnings options call for March 5th.”

Currently, the Market is on a record bull run even with the pandemic going on. There was a very slight dip in early March 2020, but it has quickly rebounded. For even a few years before that and up to now, there have been record-breaking days and weeks. But with the insane increase, there is always fear of a market correction.

Chambers had a few thoughts on the subject.

“There may be a small correction this year but I think we will have just have a lot of news-based volatility. There’s lots of euphoria and people want the bull-run to continue, so they will continue to pour cash into the market. I think that we have another year until a full correction happens,” Chambers said.

Both seniors had some advice for new investors as well.

“Make sure you have a plan specific to you and your stocks. Know when you are going to sell and cut losses,” Chambers said.

Mahesh agreed with Chambers about needing rules and plans.

“Make a list of rules and only make a trade if the stock passes all those rules,” Mahesh said. “Learn risk management. And also, watching a stock 24/7 doesn’t help it go up, but instead sets a trailing stop loss.”